Press Releases

Donalds Fights For Hardworking Floridians: Leads Bicameral Effort To Deliver Much-Needed Flood Insurance Tax Relief

Washington,

July 22, 2025

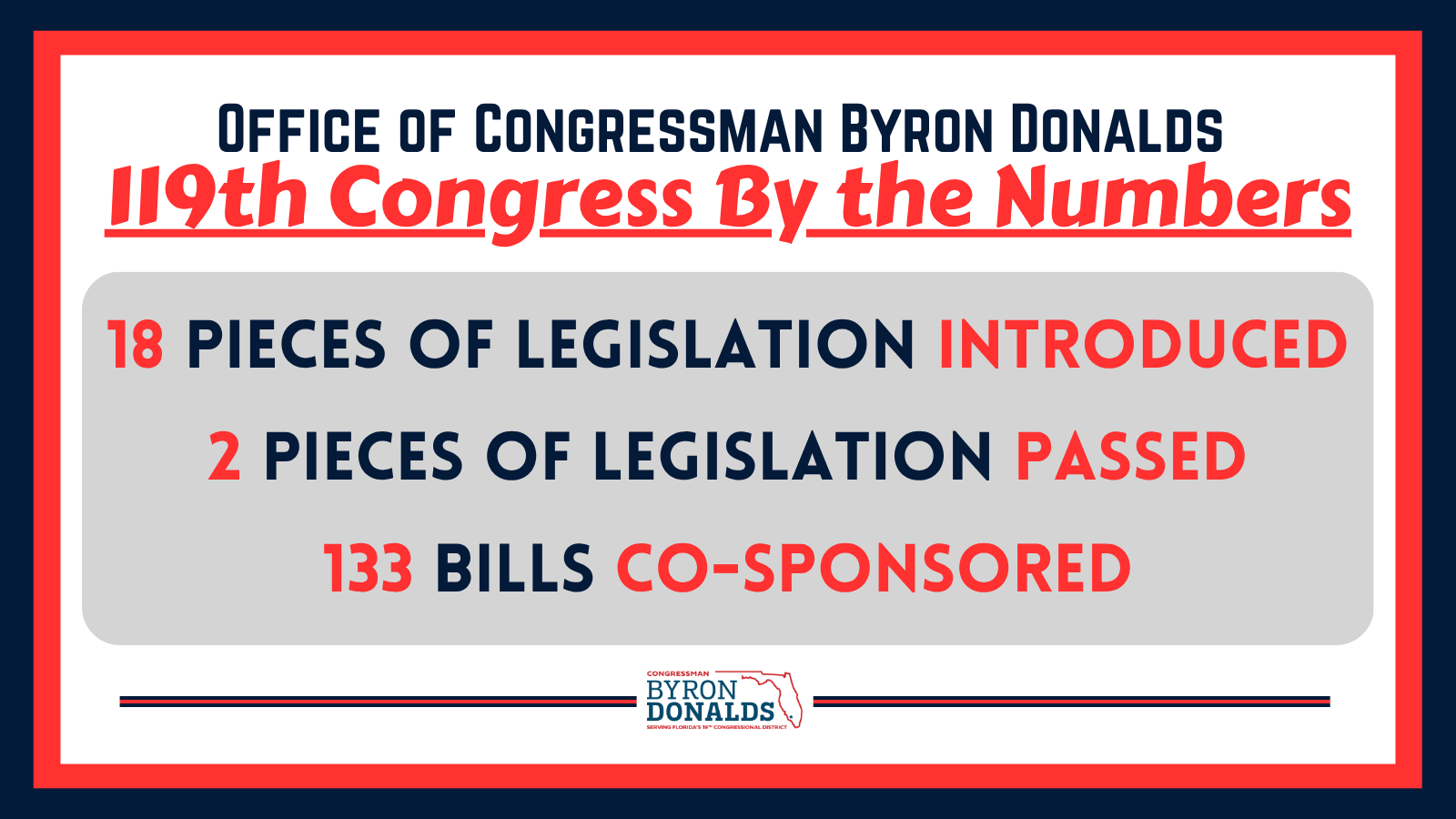

WASHINGTON – Congressman Byron Donalds (R-FL) has announced the reintroduction of legislation to provide much-needed tax relief for National Flood Insurance Program (NFIP) and private insurance policyholders across Southwest Florida, the Sunshine State, and the nation. H.R. 4494 – "The Flood Insurance Relief Act" is the 18th piece of legislation proposed by Congressman Donalds during the 119th Congress. Specifically, this bill combats the rising cost of flood insurance by creating a non-refundable tax deduction for flood insurance premiums.

“Floridians know well that flood insurance can be a crucial but costly asset, and it is unacceptable that many are left struggling to find flood insurance coverage they can afford. Families shouldn’t have to choose between protecting their homes and putting food on the table. I’ve been working on several bills to fix the broken NFIP system and encourage private-sector participation to allow for a more robust, affordable flood insurance market, but we must do more to help families ASAP. My Flood Insurance Relief Act offers a practical way to directly ease the financial burden of flood insurance for families by allowing a tax deduction on their premiums, whether through the NFIP or the private market. I’m glad to have my fellow Floridians Senator Ashley Moody and Congressman Byron Donalds joining me in leading this effort,” said Senator Rick Scott (R-FL). “As I travel around the Sunshine State, one thing folks continue to tell me is that they are worried about the rising cost of flood insurance. That is why today, Senator Scott and I are working to ease the financial burden on Florida families by proposing a bill that would create a tax deduction on their flood insurance premiums. The Flood Insurance Relief Act is a critical solution that will directly benefit Floridians, ” said Senator Ashley Moody (R-FL).

|